- Dubai, United Arab Emirates

- tameenguru@gmail.com

- +971 54 379 7955

When consumers need insurance advice, they turn to their insurance company.

Get Insurance Advice from Tameen Guru

Reinsurance is:

–A contract whereby one for a consideration agrees to indemnify another wholly or partially against loss or liability by risk the latter has assured under a separate and distinct contract as insurer of a third party.

– The Insurance of an Insurance company.

– The practice whereby insurers transfer portions of their risk portfolios to other parties by some form of agreement to reduce the likelihood of paying a large obligation resulting from an insurance claim.

Call us to get an Advice

Over 2000 Contacts Worldwide

100% Viewers Satisfaction guaranteed

First Educational Specialized Channel for Insurance

Insurance & Reinsurance Partners

Get Reinsurance Advice– instantly

Objects of Reinsurance:

- Spread of Risks

- Capacity

- Stabilization

- Confidence

- Catastrophe Protection:

- Reinsurance Services:

Characteristics of Reinsurance

- Reinsurance is a contract between the two insurance companies.

- The original insurer agrees to transfer part of his risk to other insurance

company on the same terms and conditions. - The fundamental principles of insurance such as insurable interest, utmost

good faith, indemnity, subrogation and proximate cause also apply to reinsurance. - In the event of fire, the insured is entitled to get the amount of claim only

from the original insurer and not from reinsurer. - Original insurer cannot insure the risk with a reinsurer, more than the sum

insured, originally by the insured. - The original insurer should intimate to the reinsurer about the alteration, if

any, made in terms and conditions with the insured.

Goals of Reinsurance

The cedant/reinsured’s net retained account would be protected:

- On a Single Risk by quota share and/or risk excess of loss;

- On an Aggregation of similar risks exposed to one insured peril (e.g. flood, earthquake, windstorm) by catastrophe excess of loss (property);

- On an accumulation of interests arising from a single loss event (e.g. a motor accident involving third party bodily injury, third party property damage, first party own damage to the insured’s vehicle, personal accident of the driver and passengers) by excess of loss (accident/liability/casualty);

- For small, attritional losses on the cedant/reinsured’s absolute net account by stop loss (or excess of loss)

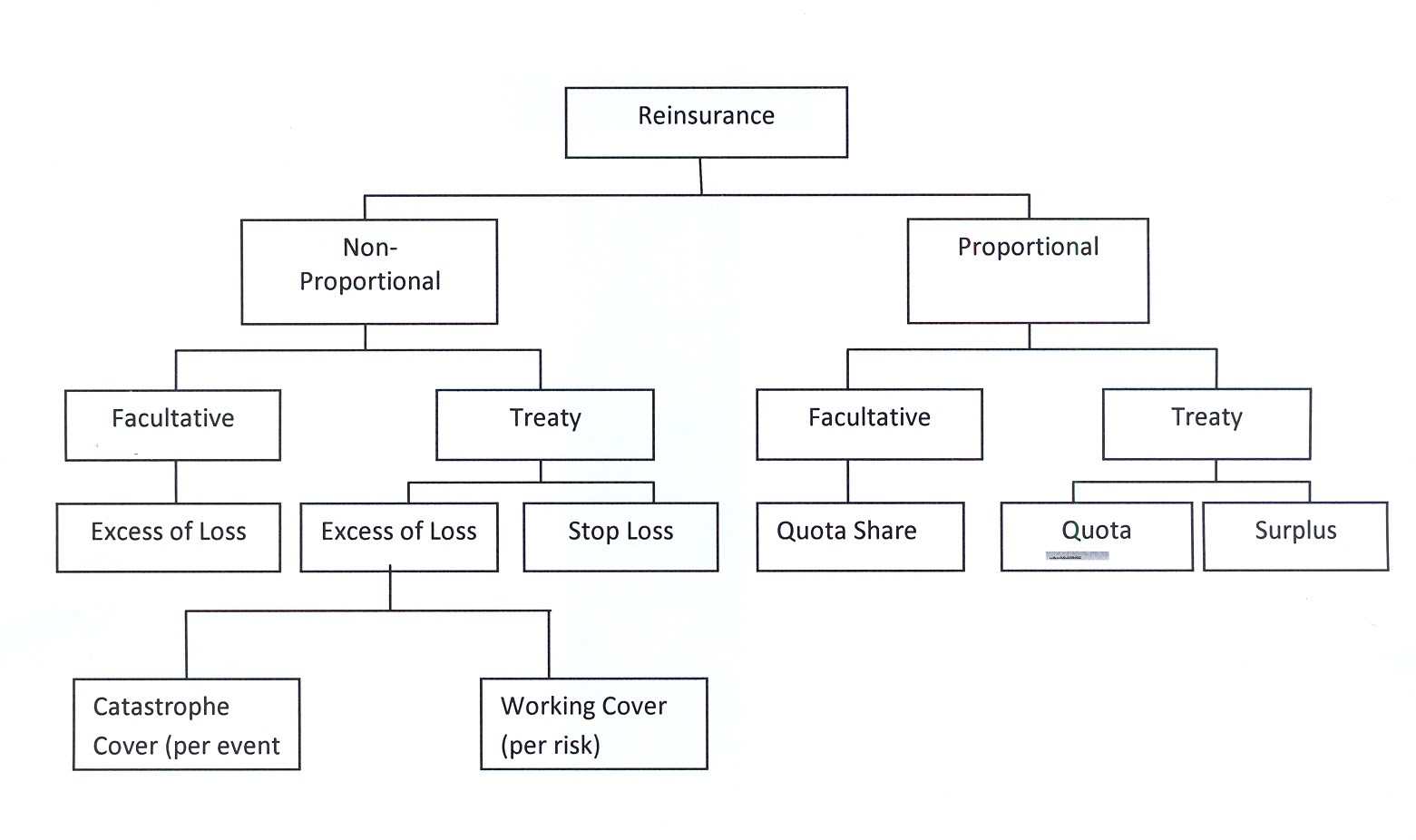

Types & Methods of Reinsurance :

Treaty and Facultative Insurance

Reinsurance may be effected by two methods. The selection of these methods depends upon the practice of insurers and the scope of their resources. These methods are:

- Facultative Reinsurance This is the oldest method of reinsurance. This method is also known as “Specific reinsurance“. Under this method, each individual risk is submitted by the ceding insurer to the reinsurer who can accept or decline whatever sum they consider appropriate subject to the amount of their acceptance being approved by the ceding insurer. The reinsurer is offered a copy of proposal form which contains details of risk such as the sum assured, salient features of the risk, perils covered, rate of premium and period of insurance etc. The reinsurer will go through the contents of the proposal form thoroughly and decide whether to accept or reject the risks. If he decides to accept, he should specify the amount for which he would accept the reinsurance. In case, the risk is not fully accepted, the original insurer may again have to approach another insurer for the balance. Any alteration, in the terms and conditions made by the original insurer is to be intimated immediately to the reinsurers. The claim is to be settled according to the ratio of risk accepted by each insurer.

- Treaty Reinsurance Treaty reinsurance has been defined as: It is a legal agreement in writing / contract between the insurer and reinsurer whereby the reinsurer will accept automatically without further negotiations any cessions falling within the terms of the agreement. Thus, under this method, there is an agreement between the ceding company and the reinsurance company that amount of every risk over and above the retention shall automatically be transferred to the reinsurance company. As soon as the original insurer accepts the risk, the excess above the retention is automatically reinsured.

Tameen Guru Youtube Channel:

Presented various topics about Reinsurance as below:

- Introduction to Reinsurance : https://bit.ly/3kxMd3I

- Treaty Renewals – Features of the Reinsurance Hard Market and its impact on Insurance Companies: https://bit.ly/3osThQC

- Conclusions of the Treaty Reinsurance & Interlocking Clause application on Proportional Treaties : https://bit.ly/31J7SiT

- Application of Interlocking Clause on Excess of Loss Treaty : https://bit.ly/3oqKEWJ

- Methods of Reinsurance and Q/S Treaty application : https://bit.ly/3C8TYTT

- Surplus Treaty application and Treaty Balance : https://bit.ly/3kqN4Dm

- Combining Q/S & Surplus Treaties , Applications and Benefits and reasons for combination: https://bit.ly/3Hg4Enq

We've got answers

Frequently Asked Questions

1.How Reinsurance helps the Insurance Company to expand?

Each policy sold carries a certain amount of risk. It also carries a certain amount of cost, from pay to sales agents to administrative costs. This is why company growth is so important. Unearned payment reserve requirements can be a burden, and reinsurance can help lessen that burden – allowing the company to focus its attention on growing the company and number of clients nationwide.

2.What are the main disadvantage of Facultative Reinsurance?

- The insurer cannot rely on successful placement of a risk.

- The administration involved is complicated and expensive.

- Detailed risk and loss information have to be disclosed.

- 'Error factor' exists in hasty facultative placements.

3.What is the Proportional reinsurance?

The insurer writes a risk and passes on the whole of it or a portion of it to the Reinsurer. The same proportion of original premium is passed on to the Reinsurer who is then committed to share in the same proportion, all claims affecting the risk .

4.What is Non Proportional reinsurance?

The insurer writes a risk and passes on a part of it to the Reinsurer. The portion of original premium is also passed on to the Reinsurer who is then committed to share on all claims affecting the risk that exceed the insurer priority up to a predetermined total sum.

5.What is the Excess of Loss Definition?

A form of reinsurance under which recoveries are available when a given loss exceeds the cedant’s retention defined in the agreement

6.What is the Non Proportional Treaty (Excess of Loss)?

A specific portfolio of a reinsured is covered against specific loss event. The reinsured and reinsurer agree on the original risks and perils to be covered which can trigger a reinsured event. They define such loss events and to what extent the original losses may or must be aggregated. Further, they define the deductible/ priority and limit of the excess of loss treaty.